Pension Basics

We encourage you to understand your benefits, rights, and obligations under The Winnipeg Civic Employees" Benefits Program.

This overview introduces the basics of Pension Plan membership and benefits. Our Member Handbook is also an excellent resource for more detailed information.

The following definitions are provided to help you understand the factors used to calculate your pension.

Credited Service— This is the period of time that you have contributed to the Pension Plan. Your Credited Service may include past service you purchased or transferred into the Pension Plan from another pension plan (i.e., a Reciprocal Transfer). Credited Service is used to calculate the amount of your pension.

Eligibility Service—This is the period of time that you have been employed and may include service prior to you becoming a member of the Pension Plan, ?but excludes periods of absence from work (e.g., lay-off, and sometimes leave of absence). If an Employee works part-time, they will earn a proportion of the year's Eligibility Service corresponding to the hours worked. Eligibility Service is used to determine when you are eligible to retire.

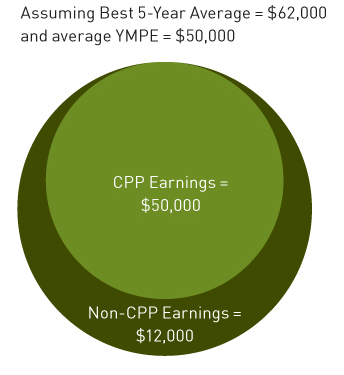

Best Five-Year Average—This is the average of your best five years of pensionable earnings during your final ten years of employment. (If you have fewer than five years of service, the average will be based on your full period of this service.) Your average pensionable earnings do not include any overtime pay; however, some pay adjustments are considered pensionable (for example, acting pay, night-shift premium and long service pay).

CPP Earnings—The Canadian government sets the YMPE (Year's Maximum Pensionable Earnings) annually—you are required to contribute to the Canada Pension Plan (CPP) on your earnings up to the YMPE. For the purpose of your pension calculation, your CPP Earnings are the lesser of your pensionable earnings and the YMPE. CPP earnings are used in the pension formula because the Pension Plan is designed to work together with CPP to provide pension benefits when you retire.

A Commuted value is the lump sum amount of money expected to be needed, together with future investment earnings, to pay a pension after retirement taking into account such factors as a Member's age and assumptions of future rates of investment return and future rates of mortality. In accordance with provincial pension law, Commuted Values must be calculated using the calculation method prescribed by the Canadian Institute of Actuaries.

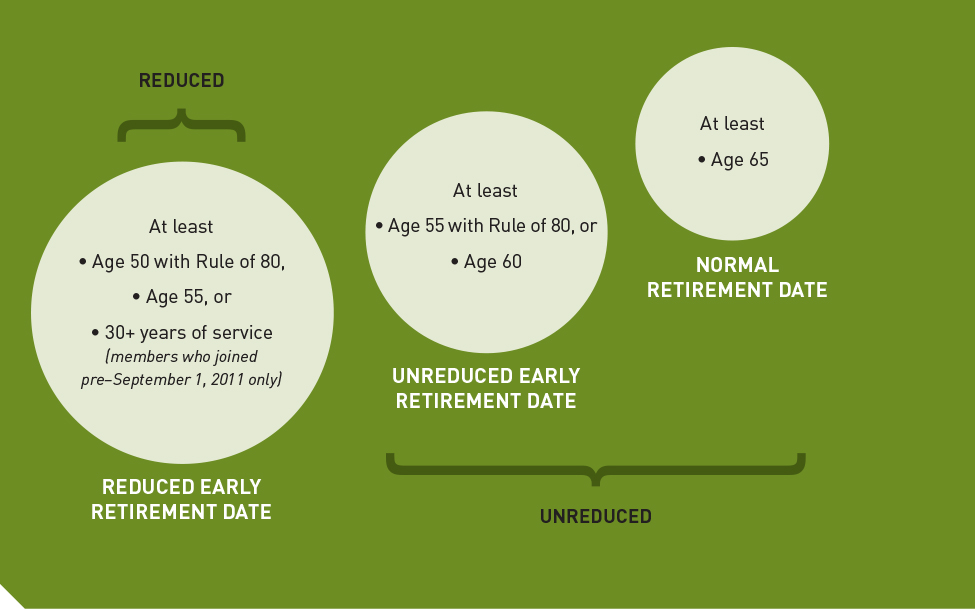

Your age and your Eligibility Service are used to determine when you are eligible for a pension, and to calculate any early retirement reduction.

Normal Retirement Date—The Normal Retirement Date under the Pension Plan is the last day of the pay period in which you turn age 65.

Unreduced Early Retirement Date—Alternatively, you may elect to retire on the last day of the pay period in which you turn age 60, or age 55 with Rule of 80, without penalty.

Reduced Early Retirement Date—You qualify for early retirement when you are age 55, or when you are at least age 50 and have attained Rule of 80, or if you joined the Plan before September 1, 2011 and you have at least 30 years of eligibility service. Your pension will be subject to an early retirement reduction.

Rule of 80—You have attained Rule of 80 when your age plus Eligibility Service total at least 80.